Last Week’s Markets in Review: Current Prices, Inflation and Monetary Policy

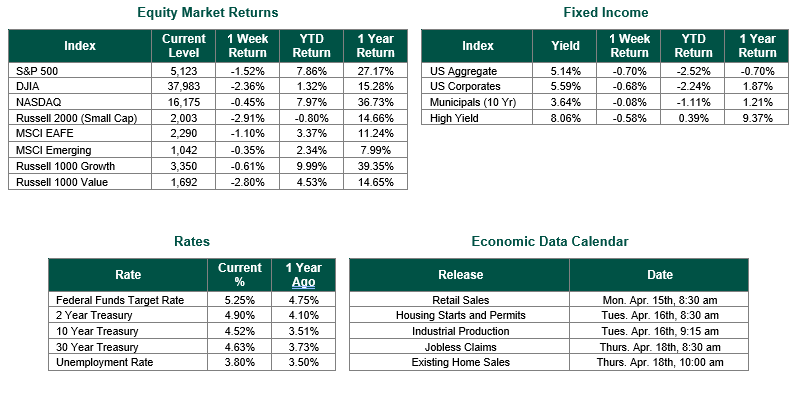

Global equity markets finished lower for the week. In the U.S., the S&P 500 Index closed the Week at a level of 5,123, representing a decline of 1.52%, while the Russell Midcap Index moved -2.89% last Week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -2.91% over the Week. As developed international equity performance and emerging markets were lower, returning -1.10% and -0.35%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the Week at 4.52%.

In the prior Week, market participants were focused on two data points concerning ongoing inflation in the domestic economy. The first data the Consumer Price Index (CPI) for March was released on Wednesday. This was followed by the Producer Price Index for March on Thursday.

The CPI rose 0.4% for the month, putting the 12-month inflation rate at 3.5%, or 0.3 percentage points higher than in February. Economists surveyed by Dow Jones had been looking for a 0.3% gain and a 3.4% year-over-year level. Excluding the volatile food and energy components, the core CPI reading also accelerated 0.4% on a monthly basis while rising 3.8% from a year ago, compared with respective estimates for 0.3% and 3.7%. The following day the producer price index rose 0.2% for the month, less than the 0.3% estimate from the Dow Jones consensus and not as much as the 0.6% increase in February. However, on a 12-month basis, the PPI climbed 2.1%, the biggest gain since April 2023, indicating pipeline pressures that could keep inflation elevated.

We have suggested for quite some time now that the market has gotten ahead of itself in 2024, pricing in the perfect execution of a soft landing by the Federal Reserve involving continued moderation of inflationary pressures and rate cuts this year. In our view, we are not there yet, and more short-term bouts of volatility ahead are likely as a result until the Fed embarks upon its forecasted rate-cutting campaign. However, we also need to recognize that just a couple of weeks ago, following the FOMC meeting on March 20, the Fed increased their forecast for Core PCE in 2024 to 2.6% and further forecasting that Core PCE will not return to their 2% target until 2026.

Based on their March 20 Dot Plot chart, the Fed is still forecasting three (3) rate cuts of 25 Bp each in 2024, despite their own inflation forecasts. It is important to remember that the Fed is trying to thread the needle here (stuck between a rock and a hard place, if you will), and history, notably the mid-1970s – early 1980s, shows that either cutting rates too soon or keeping rates too high, could have damaging consequences. For perspective, the Fed Funds Target Rate is at its highest level in 22 years. Even if they cut interest rates by 75 Bp this year, the Fed Funds Target Rate will remain at its highest level in 17 years. Hence, “rates will remain higher for longer,” but hopefully not too high for too long.

Overall, if we look beyond when the first rate cut will occur, it is hard to argue that interest rates, yields, and inflation will not be lower over the next 2- 3 years, and that outlook creates opportunities in both stocks and bonds for investors to consider.

Best wishes for the week ahead.

Both CPI and PPI data are sourced from the U. S. Bureau of Labor Statistics. Economic Calendar Data from Econoday as of 4/12/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.